Overview

Value-Added Tax (VAT) or, in some countries, Goods and Services Tax (GST), is an alternate form of tax required in particular countries such as ones within the EU. This article will guide you in the proper set up of this feature. If you have not done so, please read the instructions for setting up tax rates and regions below:

Enabling VAT:

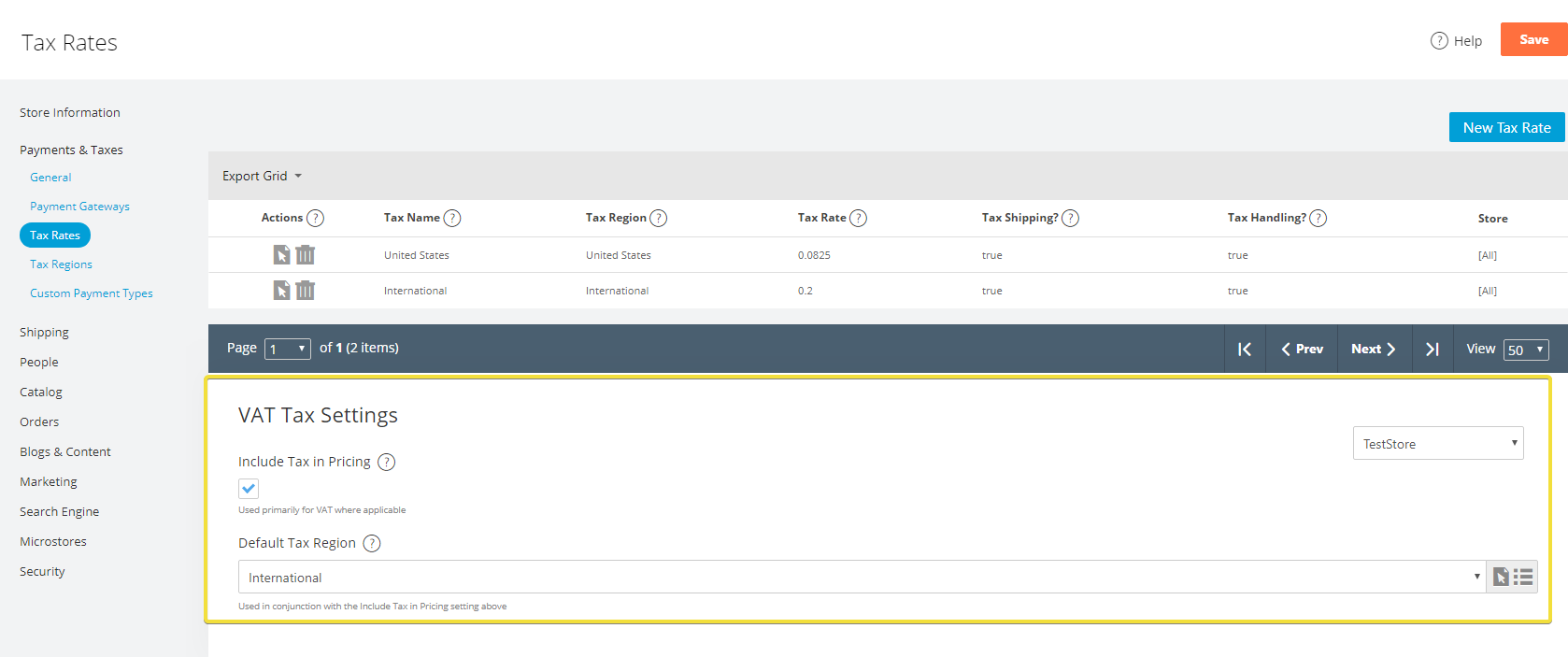

Navigate to Settings > Payments & Taxes > Tax Rates. Below your tax rates, you will find the VAT Settings.

Enabling Include Tax in Pricing will include the tax in the product price instead of listing it separately. This is primarily used for VAT where it is applicable.

The Default Tax Region is used in conjunction with the Include Tax in Pricing setting.

Useful Merges:

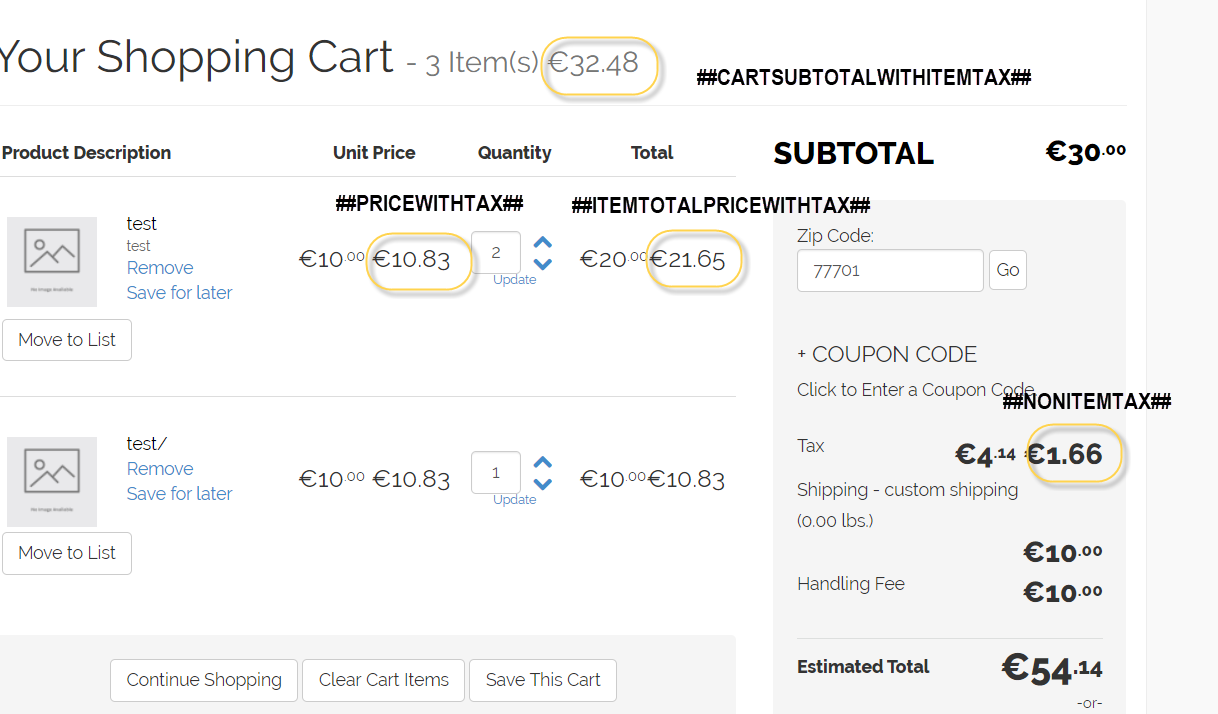

Below is list of merge codes for your shopping cart page that are useful with the VAT settings:

- ##CARTSUBTOTALWITHITEMTAX##

- ##ITEMTOTALPRICEWITHTAX##

- ##NONITEMTAX##

- ##PRICEWITHTAX##

You will need to access your Shopping Cart Page's HTML to add these merge codes and/or replace the existing ones. To do this, navigate to Themes > Edit > Pages > Shopping Cart > HTML.

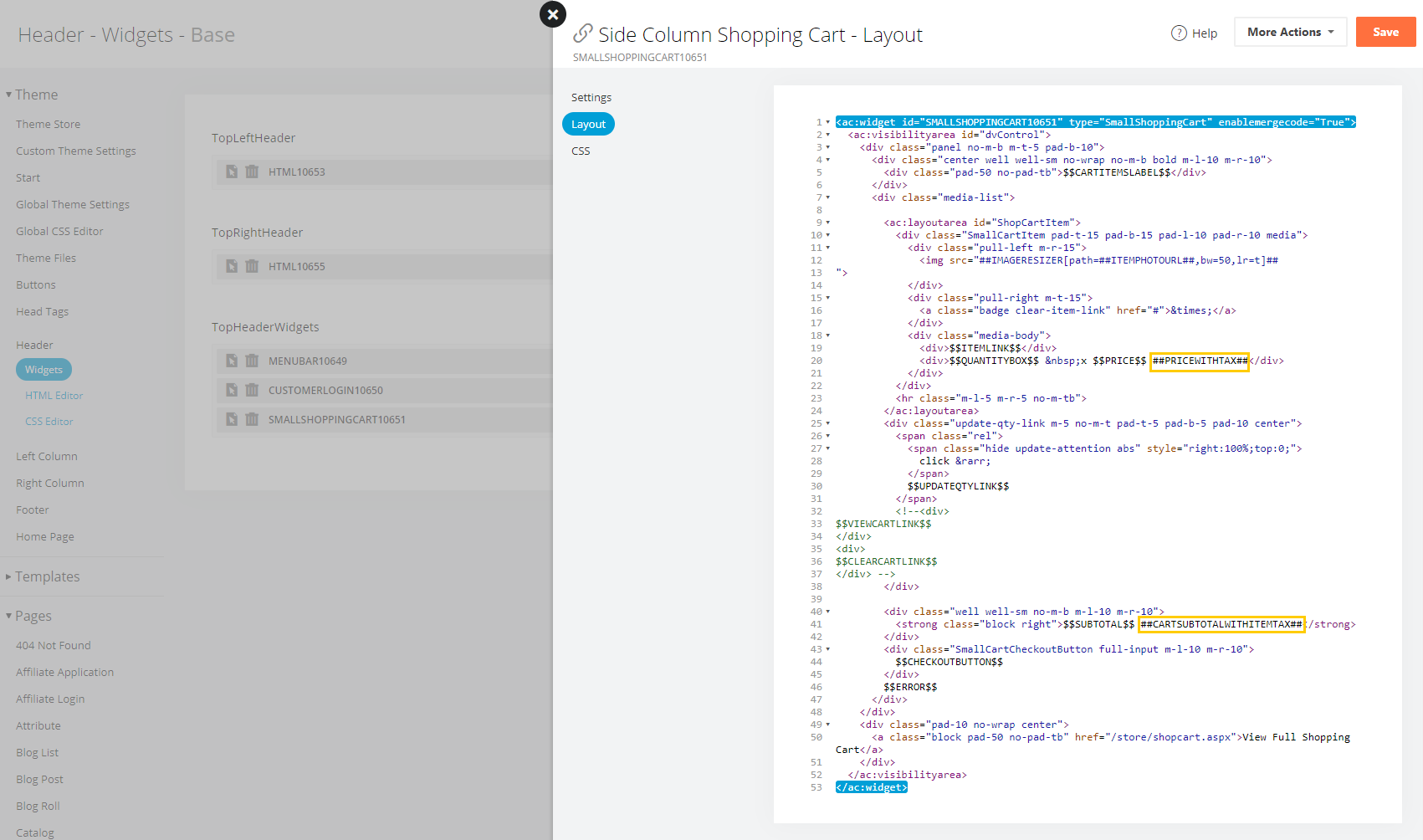

If you have a shopping cart drop down, you will need to change these as well. The location of the small shopping cart will differ based on how your theme is set up. You can generally find this in Themes > Edit > Header > Widgets, but may differ on a customized theme.

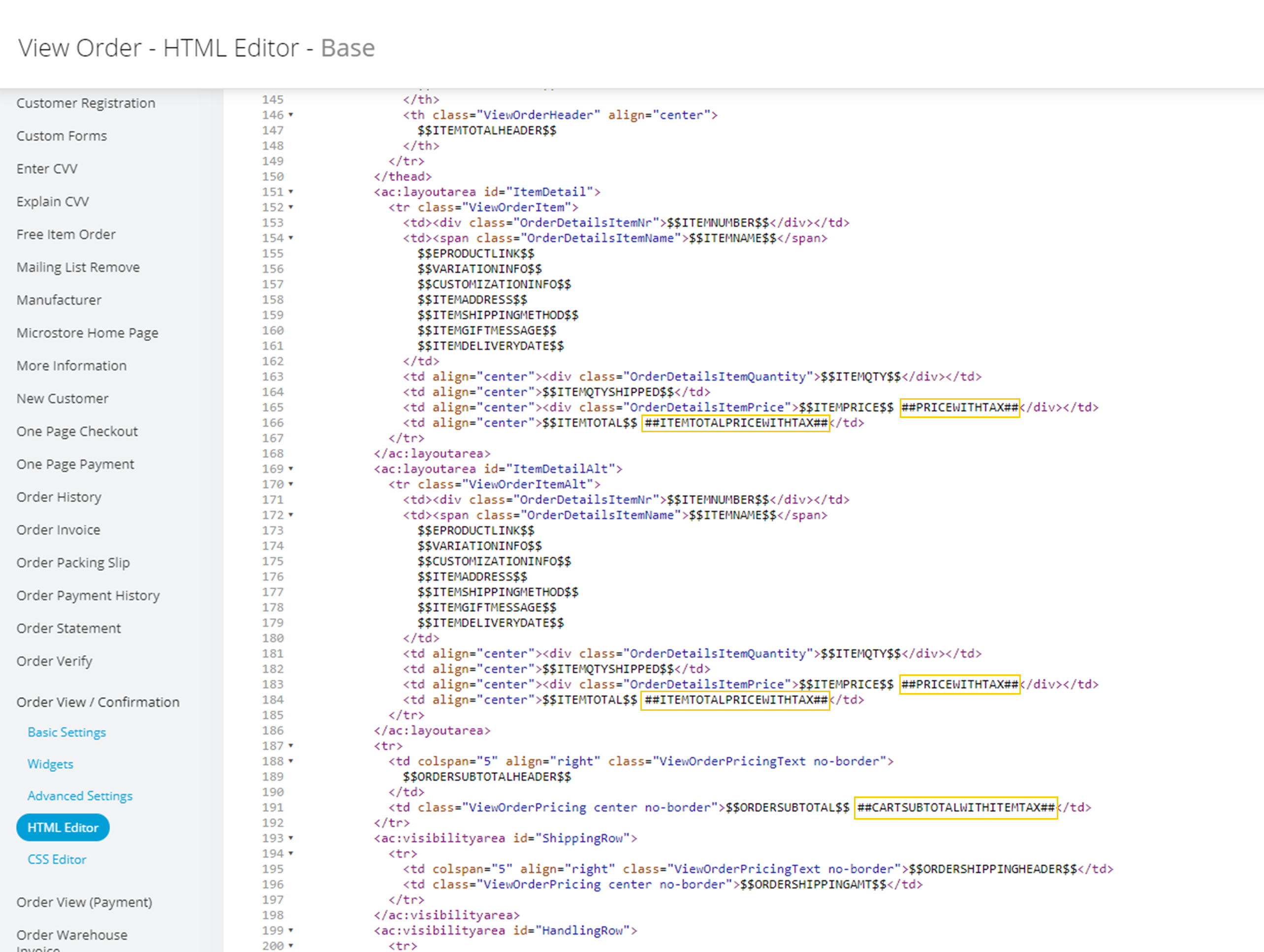

The Order Confirmation page is another location you may want to update these merge codes. You can find the html for this page by navigating to Themes > Edit > Pages > Order View/Confirmation.